Crypto tax calculator usa

The first one and the easiest and most reliable is connecting your exchange or wallet through an API key or public address. How to calculate your crypto tax in the US.

Crypto Tax Rates Capital Gains Tax A Break Down On How It All Works

Calculations are estimates based.

. Cryptocurrencies are taxed as property in the United States not as a currency. To help you with your tax planning for tax year 2021 you can also find out if you have a capital gain or loss and compare your tax outcome of a short term versus long term. How to Calculate Crypto Gambling Taxes.

Enter the sale date and sale price. Crypto Tax Calculators annual subscription ranges from 49 to 299 and supports up to 100000 transactions. Calculating your crypto gambling taxes is easy.

Enter the purchase date and purchase price. 1 Add data from hundreds of sources Directly upload your transaction history via CSV or API. In this example the cost basis of the 2 BTC disposed would be 35000 10000 500002.

Crypto tax calculators work in several ways. On this crypto gains calculator you see five different areas. Dont have an account.

Generate crypto tax reports covering everything from NFTs to DeFi and DEX. Integrates with 500 major exchanges wallets and chains. The popularity of cryptocurrencyBitcoin investments continues to skyrocket.

CryptoTaxCalculator helps ease the pain of preparing your crypto taxes in a few easy steps. This means that the same tax rules which apply to property. Crypto tax software is integrated with major crypto exchanges blockchains and wallets and can help you with reporting and filing your crypto taxes.

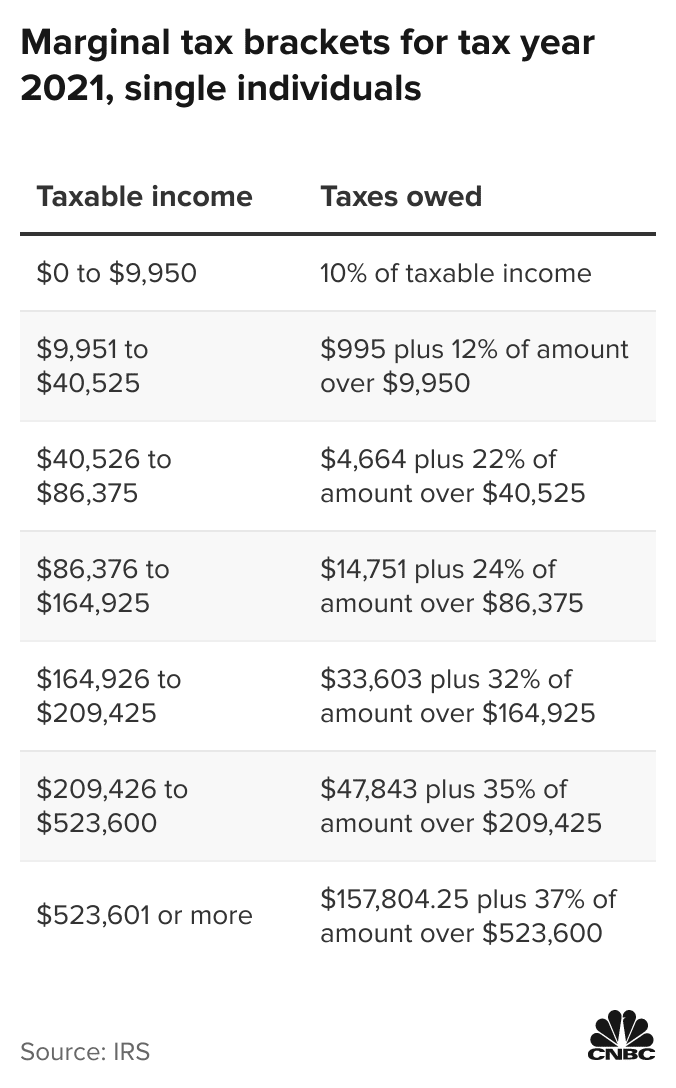

If you are using ACB Adjusted cost base method the cost basis of sale will be determined by. Calculate your crypto taxes and learn how you can minimize crypto taxes for the USA UK Canada and Australia. On the opposite side of the spectrum those making 518401 or more will pay around 37.

If your annual income is less than 9875 youll be subject to a 10 tax rate on your crypto. Tax-Loss Harvesting With A Crypto Tax Calculator. Use our calculator to get an estimate of the taxes on your cryptocurrencybitcoin sales.

At ZenLedger you can use. The FMV of your crypto at the time of receiving it is the amount on which youll pay. According to a May 2021 poll 51.

How much does Crypto Tax Calculator cost. The purchase date can be any time up to December 31st of the tax year selected. Crypto Tax Calculator.

Crypto Tax Calculator. Cryptocurrency Tax Calculator. February 12 2022 by haruinvest.

Write the total amount of USD you have. In general terms losses resulting from cryptocurrency trades are tallied against any gains. Free Crypto Tax Calculator for 2021 2022.

Use our crypto tax calculator below to determine how much tax you might pay on crypto you sold spent or exchanged.

![]()

What Is My Tax Rate For My Crypto Gains Cointracker

Cryptocurrency Taxes What To Know For 2021 Money

10 Best Crypto Tax Software In 2022 Top Selective Only

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

Crypto Tax Calculator

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

Calculate Your Crypto Taxes With Ease Koinly

Bitcoin Tax Calculator Easily Calculate Your Tax Obligation Zenledger

Us Tax Rates For Crypto Bitcoin 2022 Koinly

Crypto Tax Calculator

Cryptocurrency Tax Guides Help Koinly

Capital Gains Tax Calculator Ey Us

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Us Tax Rates For Crypto Bitcoin 2022 Koinly

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Cryptocurrency Tax Calculator Forbes Advisor

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare